In the fast-paced world of online trading, being a successful Pocket Option Trader Pocket Option free demo account trader requires knowledge, strategy, and a keen understanding of market dynamics. Pocket Option, a popular trading platform, has gained traction among both novice and experienced traders due to its user-friendly interface and a wide array of trading options. In this article, we will delve into the essentials that can help you maximize your trading success on Pocket Option.

Understanding Pocket Option

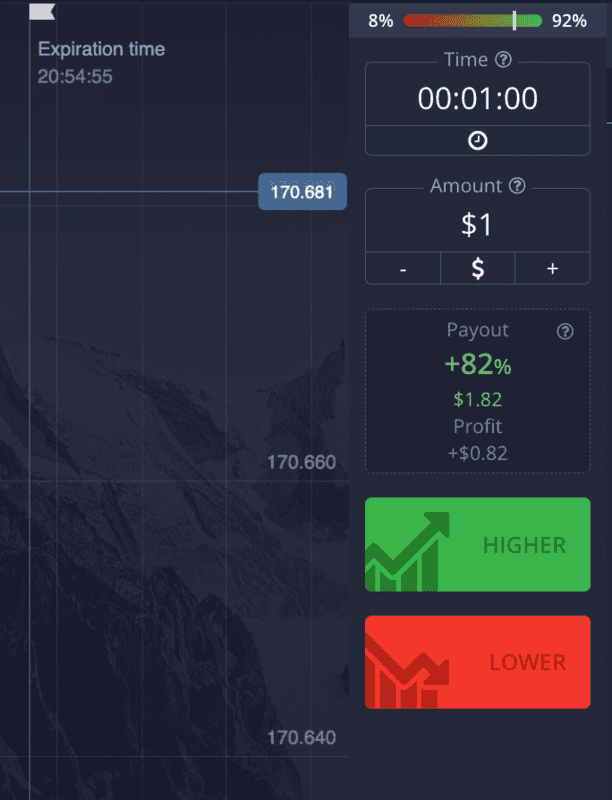

Pocket Option is a well-known platform that offers a straightforward way to engage in options trading. It allows users to trade various assets, including currencies, commodities, and cryptocurrencies. One of the standout features of Pocket Option is its accessibility, enabling traders to open an account with minimal financial commitment. This factor makes it an attractive choice for beginners looking to dip their toes into online trading.

Setting Up Your Account

Getting started on Pocket Option is simple. All you need to do is create an account, which can be done in a matter of minutes. The platform offers different types of accounts, each catering to various trading styles and levels of experience. As a new trader, it is wise to start with a demo account to practice trading strategies without risking real money. This can build your confidence and help you develop a better understanding of market movements and analysis techniques.

Using the Pocket Option Demo Account

The demo account feature is invaluable for any Pocket Option trader. It provides a risk-free environment where you can learn the ins and outs of trading. You can experiment with various strategies, test different asset classes, and familiarize yourself with the trading interface. The demo account comes with virtual funds, allowing you to engage in real-time trading scenarios without financial risk. This practice can be crucial for developing effective trading strategies before switching to a live account.

Trading Strategies

Successful trading on Pocket Option often hinges on a well-thought-out strategy. Here are several strategies that traders commonly use:

- Trend Following: This strategy involves identifying the direction of the market trend and placing trades that align with it. Traders often use technical analysis tools to determine whether the market is in an uptrend or downtrend.

- Range Trading: In contrast to trend following, range trading focuses on identifying key support and resistance levels. Traders buy at support and sell at resistance, profiting from price fluctuations within a defined range.

- Breakout Trading: This strategy seeks to capitalize on price movements that occur when the price breaks through support or resistance levels. Traders enter positions at the breakout point, anticipating that the price will continue in that direction.

- News Trading: Traders who employ this strategy make trades based on news releases or economic reports that can influence market movements. Staying informed about upcoming events can provide advantageous trading opportunities.

Technical Analysis Tools

A key component of successful trading is the ability to analyze market data effectively. Pocket Option provides various technical analysis tools that can assist traders in making informed decisions. These tools include:

- Indicators: Traders can utilize numerous indicators, such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands, to assess market conditions.

- Charts: Pocket Option offers different chart types, including line, candlestick, and bar charts, which allow traders to visualize price movements over time.

- Pattern Recognition: Identifying chart patterns, such as head and shoulders or double tops, can provide insights into potential market reversals or continuations.

Risk Management

Effective risk management is crucial for any Pocket Option trader. It involves setting limits on potential losses and defining your risk tolerance. Here are some key practices for managing risk:

- Set Stop-Loss Orders: Stop-loss orders automatically close a position when it reaches a predetermined price, helping to minimize losses.

- Diversify Your Portfolio: Avoid putting all your capital into a single trade. Diversifying across different asset classes can help spread risk.

- Limit Your Exposure: Only risk a small percentage of your trading capital on a single trade to protect your overall portfolio.

Continuous Learning and Adaptation

The trading landscape is constantly evolving, and successful Pocket Option traders recognize the importance of continuous learning. Here are some ways to keep your skills sharp:

- Stay Informed: Follow financial news and updates to stay abreast of market trends that can impact your trades.

- Analyze Your Trades: Regularly review your trades to identify what worked and what didn’t. Adjust your strategies based on your findings.

- Join Online Communities: Engaging with other traders through forums or social media can provide valuable insights and tips.

Conclusion

In summary, becoming a successful Pocket Option trader requires dedication, strategy, and ongoing education. By leveraging the demo account, mastering various trading tactics, and implementing effective risk management practices, you can enhance your trading results. Remember, the journey to becoming a skilled trader is a continuous process, and the more time you invest in learning and adapting, the greater your chances of success in the dynamic world of online trading.