Decentralized Exchanges (DEX) efforts as opposed to a central expert, leverage smart contracts to do trades personally between pages. DEX programs offer better privacy and you will head possession out of possessions. Here are a few Atomic DApps shop discover best choices for smooth change. Shelter try a significant foundation in terms of cryptocurrency exchanges, since they’re tend to focused by code hackers and you can cybercriminals.

One another continues to exist, and lots of traders will use a mixture of both according to demands. This will make it nearly impossible to own governments to close off her or him down totally. To hyperliquid app your lower organizations such Binance Smart Chain or Polygon, he or she is reduced. Hackers along with attack her or him because the large volumes of cash try held under one roof. Certain transfers were turn off before, and this brought about users to reduce currency. Therefore, if you are an amateur, purchase the centralized change system, and that is a casual selection for a soft and you may easy experience.

Hyperliquid app – To your dictate from antique and you can automatic business producers for the market quality inside cryptoeconomic possibilities

Celebrated centralized transfers tend to be Coinbase, Binance, Kraken, and you may Gemini, to name a few. For everyone of their complexity, blockchain’s possible as the a decentralized form of list-remaining is almost as opposed to limit. Away from deeper affiliate confidentiality and you can heightened shelter to reduce control charge and you can a lot fewer mistakes, blockchain tech may see applications beyond those people outlined a lot more than. A great blockchain is a distributed databases otherwise ledger mutual across the an excellent computer network’s nodes. While it is best known because of its extremely important character inside cryptocurrency solutions, maintaining a safe and decentralized checklist out of purchases, blockchains are not restricted to cryptocurrency spends.

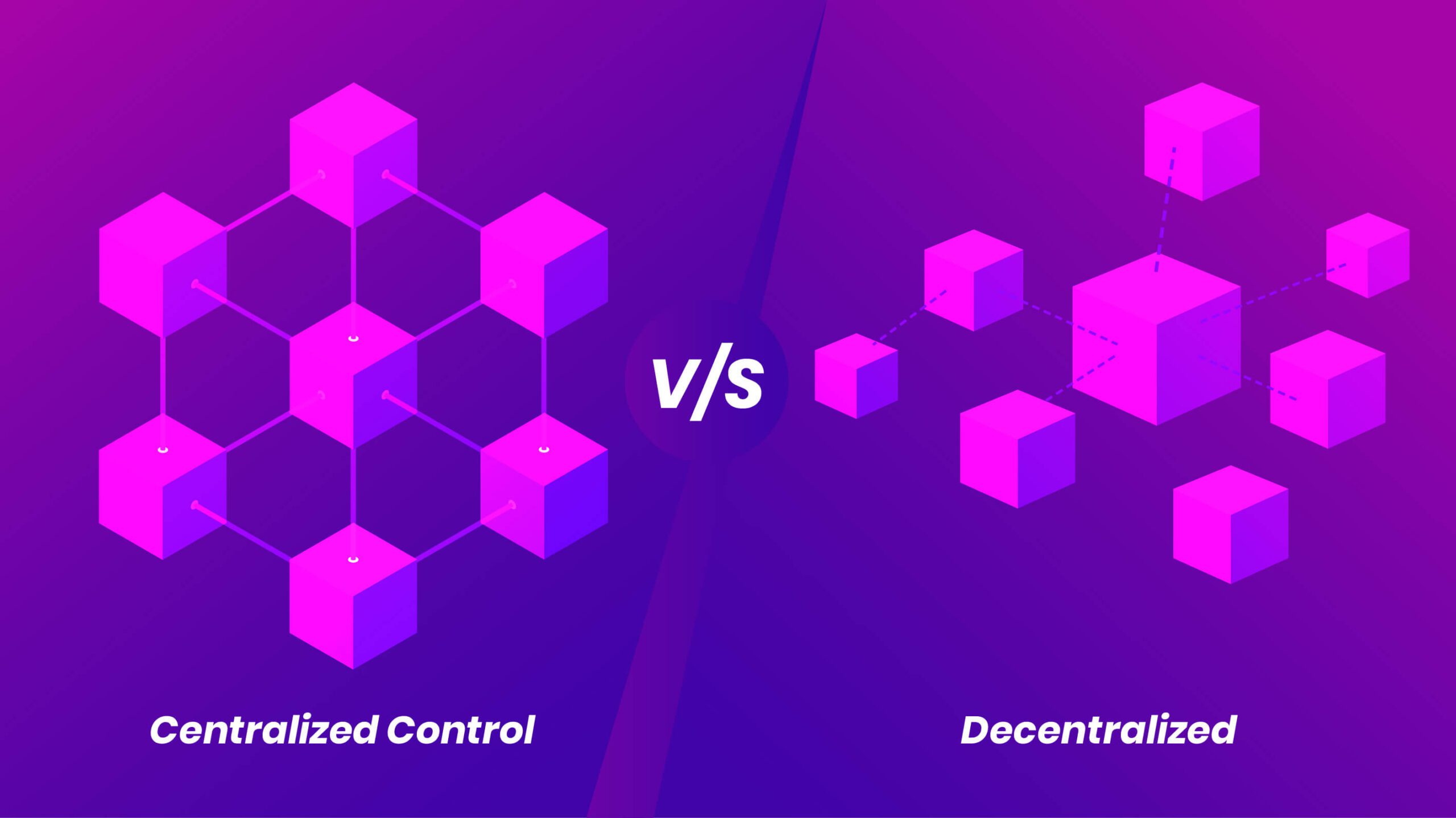

Centralized Against Decentralized Transfers (CEX against DEX): Said

The complete registered member base reaches 487 million profile around the world. This type of quantity emphasize the new broadening acceptance of crypto trading systems. Advantages borrowing from the bank so it gains in order to better laws and regulations and better security features. Biggest transfers today provide complex systems you to definitely interest various investors. The marketplace worth of best cryptocurrencies is far more stable, encouraging constant trading. Decentralized and you may centralized exchanges tend to attract buyers from specific experience membership.

- On the lower stores such Binance Smart Strings or Polygon, he’s dramatically reduced.

- They mix conventional assets that have electronic currencies within their points.

- Huge CEX systems such Binance otherwise Coinbase have scores of users and you can billions in the each day exchange frequency.

- Which have other opportunities inside help electronic advantage positions, both exchanges enable the next trend of monetary and you may technological innovation.

- Which brings anonymity and attracts pages who do not need to help you reveal its term.

The fresh aspect of accessibility is even an important stress from the centralized exchange compared to decentralized replace contrasting. Central teams operate centralized exchanges and are more susceptible to help you crashes. Such as, centralized transfers can reduce access to pages to reduce loss within the the event away from enormous market accidents. Quite the opposite, decentralized transfers wear’t have issues as they wear’t have intermediaries. You can always availability DEXs, regardless of field injuries, and use their property as you would like.

As opposed to CEXs, decentralized exchanges do not require representative membership or custodial wallets. Rather, your link your own low-custodial bag (for example MetaMask or Ledger) and you will interact with wise deals directly on the new blockchain. Decentralized transfers allow it to be fellow-to-fellow cryptocurrency trading with no importance of middlemen. These networks believe in the fresh blockchain system and you will smart deals to help you perform transactions personally anywhere between somebody, growing defense and you can liberty. Each other centralized and you may decentralized exchanges shape the surroundings of digital advantage trading with their characteristics, pros, and drawbacks. To navigate best and make smart behavior since the a trader or buyer, it is important to grasp every piece of information out of both change systems.

Crypto Trade: How Morgan Stanley Are Changing Digital Advantage Combination

A central crypto replace is a patio one to allows buyers to buy, promote, and change cryptocurrencies securely within the governance of a central authority. CEX platforms serve as intermediaries, bringing protection, highest liquidity, user-friendly connects, and you can fast to pages, permitting them to trading trouble-100 percent free, in the a safe and you will safer ecosystem. A central crypto exchange are an internet site . where you could purchase and sell electronic possessions. Central crypto exchanges act like a middleman ranging from consumers and you may sellers.

The newest CEX has a market inventor you to definitely motions your order publication and you can links pick sales having sell sales by decreasing the acquisition publication pass on. A market with a high exchangeability is just one in which sales will be occupied easily and at prices that will be near the most recent market price. It’s also important to remember that one CEXs provides insurance coverage and you may protect users in the eventuality of replace situations. People of all of the ability accounts are able to use its representative connects as opposed to spending too much time figuring him or her away. As there’s zero main entity carrying your assets, the possibility of a large-scale cheat try shorter.

Knowledge KYC and you may AML Conformity

Centralized exchanges functions similarly to antique exchanges, where traders perform a free account, deposit their cash, and set purchases to find or sell cryptocurrencies. For every crypto replace features its own buy book, which information all of the buy and sell requests on that type of platform. Also, CEX costs charge to possess deals, withdrawals, if not places. Central transfers can be used to perform exchanges from fiat to help you cryptocurrency (otherwise the other way around). Decentralized exchanges don’t provide this particular service, simply making it possible for crypto-to-crypto exchanges.

Following the transaction try verified, it’s put into the fresh blockchain cut off. For every cut off on the blockchain include their novel hash plus the book hash of the take off earlier. For this reason, the fresh stops can’t be altered while the system verifies him or her.

For this reason, crypto residents wear’t provides complete control of their property on the central transfers. If you are both participants on the CEX vs DEX crypto change discussion supply the abilities to own crypto trade, it differ in lot of other variables. Such as, the sort of change takes on a vital role inside the determining exactly how a certain transaction functions. Meanwhile, the features for the affiliate and you will self-reliance in addition to disagree a lot more in the the two type of exchanges. Hence, an elementary review of the 2 kind of crypto transfers can also be place the best build to own an evaluation among them. Centralized cryptocurrency exchanges are businesses that provide cryptocurrency services including fiat/crypto transfers, trade sets, and other trade possibilities.

Yet not, this provides believe your change lasts on the long run and makes it simple in order to discern if this’s reputable. You could think of her or him because the crypto equivalent of inventory exchanges because they works almost identically and you will suffice an identical goal. This really is only the tip of your own iceberg, whether or not, because there’s such one to separates the 2, leading them to popular with different kind of crypto people. The brand new aggregator standards such 1inch have emerged particularly to help larger investors avoid exchangeability issues when using DEXs. 1inch raised $twelve million inside 2020 inside the a financing bullet added by Pantera Investment.

The brand new program away from a good DEX is designed to end up being representative-friendly inspite of the complexity of their backend functions. Often, you could change tokens myself inside your handbag, taking a smooth trade feel. KYC procedures ensure the program can be track private transactions, reducing the threat of ripoff and you may illegal things. Conformity having AML regulations facilitate place and prevent currency laundering. Although not, certain DEXs has used liquidity pools and bonuses to enhance the exchangeability. Knowledge liquidity is vital to own productive trading during these platforms.