- Best cryptocurrency to invest in 2025

- Cryptocurrency market trends february 2025

- Cryptocurrency market analysis april 2025

Best cryptocurrency to buy now april 2025

The inclusion of cryptocurrencies like Bitcoin, Ethereum, XRP, Solana, and Cardano in the U.S. strategic crypto reserve marks a pivotal moment for institutional and governmental involvement winport no deposit code. This move has increased mainstream acceptance and provided additional credibility to digital assets.

These developments suggest a maturing cryptocurrency market with increased emphasis on technology, sustainability, and market stability. Future trends may see more institutional investments and a higher integration of cryptocurrencies in mainstream financial transactions.

Cardano, known for its research-driven approach to blockchain development, has continued to make significant advancements in scalability, governance, and interoperability. The deployment of smart contracts on the Cardano network has led to increased adoption in DeFi, gaming, and enterprise blockchain solutions. With its robust focus on sustainability and real-world applications, Cardano remains a strong contender in the crypto space.

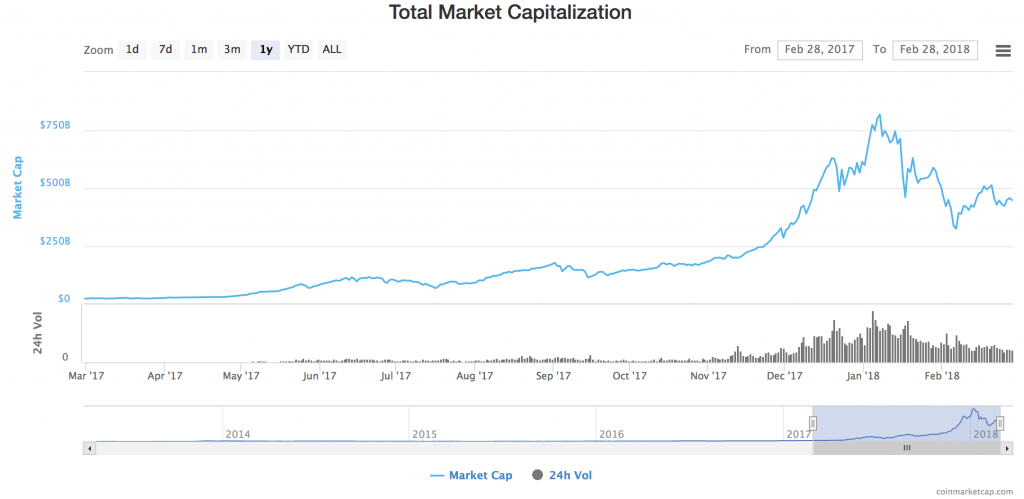

Regulatory progress may be continuing unabated, but unfortunately this has not translated into a continued bull run for cryptocurrency prices. Starting in February, the price of Bitcoin and other major cryptos began to reverse course.

Best cryptocurrency to invest in 2025

Toncoin (TON) is a blockchain project backed by Telegram, offering decentralized messaging, storage, and Web3 services. With millions of Telegram users, Toncoin has strong integration potential, allowing for secure crypto transactions and digital identity verification.

Several cryptos have a high potential to increase in value in 2025. These include Bitcoin, Ethereum, Solana, Dogecoin, Cardano, Solana, XRP, , and Binance Coin (BNB). These coins have gained traction due to their innovative technology and potential use cases. Additionally, these coins are backed by strong development teams and have the potential to become major players in the cryptocurrency space.

Bitcoin is the pioneering cryptocurrency and is still the go-to choice for many experts today. It has a market cap of over $1.8 trillion and is seen as a store of value and digital gold by many investors. The coin is also used for payments, remittances, and more. The Bitcoin blockchain remains secure and decentralized despite its large size and numerous forks.

In recent years, Dogecoin’s price has experienced dramatic fluctuations, with notable spikes driven by market sentiment and broader cryptocurrency trends. Analysts predict that DOGE could see substantial growth in the coming years, potentially reaching new all-time highs, depending on factors such as market dynamics, technological advancements, and increased adoption as a payment method.

Cardano is known for its scalability, security, and sustainability. It also has a unique consensus algorithm called Ouroboros that helps to secure the network and ensure its decentralization. The platform is also designed to be energy-efficient, making it more attractive to investors looking for eco-friendly investments.

Cryptocurrency market trends february 2025

The important Fibonacci level of $1.104 will play a pivotal role in determining its bullish potential. Institutional adoption and advancements in real-world asset integration could drive ONDO‘s growth, with significant upside potential if key levels are surpassed.

The Stacks long term chart looks bullish. It is printing a series of bullish reversal in the context of a long term uptrend. An acceleration point will be hit, sooner or later, presumably on BTC bullish momentum somewhere in 2025.

In 2025, Ethereum is expected to trade in a wide range with a minimum price of $1,667 and maximum price of $4,911. If and whenever bullish momentum in crypto markets accelerates, ETH may push to our stretched price target of $5,590.

However, this momentum slowed in late January after DeepSeek’s AI model development raised concerns about the overvaluation of U.S. tech stocks, leading to a market-wide sell-off that affected both traditional finance and digital assets.

The important Fibonacci level of $1.104 will play a pivotal role in determining its bullish potential. Institutional adoption and advancements in real-world asset integration could drive ONDO‘s growth, with significant upside potential if key levels are surpassed.

The Stacks long term chart looks bullish. It is printing a series of bullish reversal in the context of a long term uptrend. An acceleration point will be hit, sooner or later, presumably on BTC bullish momentum somewhere in 2025.

Cryptocurrency market analysis april 2025

In summary, if the Fed maintains a hawkish stance, US Treasury yields may continue to rise, and the crypto world may face sustained selling pressure; conversely, if economic data weakens or geopolitical risks ease, funds may flow back to risk assets like cryptocurrencies.

The cryptocurrency market’s volatility can be attributed to several factors. Bitcoin’s dominance increase suggests a flight to safety as investors possibly view it as a hedge against broader market uncertainty. Ethereum’s significant downturn, on the other hand, could be influenced by its reduced market dominance and possibly internal ecosystem challenges.

In the final week of April, XRP experienced a decisive breakout toward $2.30, reaching its monthly high. The rally was triggered by the launch of the first U.S.-based XRP Exchange-Traded Fund (ETF), introduced by a leading asset management firm. The fund allowed traditional investors to gain exposure to XRP through regulated channels, enhancing accessibility and liquidity.

In a notable legal endeavor, crypto lawyer James Murphy has filed a lawsuit against the U.S. Department of Homeland Security to uncover information regarding a meeting potentially linked to Bitcoin’s creator, Satoshi Nakamoto.

Technically, Ethereum held strong support around $1,400 during its sharp decline early in the month. The successful bounce back above $1,700 validated that support zone and demonstrated buyers’ readiness to enter at discounted levels. Meanwhile, resistance near $1,820 proved difficult to overcome, indicating that any bullish continuation would need significant momentum or positive market catalysts.